Are you trying to save for a down payment on a house, but there isn’t enough money left over at the end of the month? We know how you feel! How come it’s so challenging to save money!? Let’s consider what you should include in your monthly budget to save for a down payment on a new house.

You start saving $50/month, and suddenly you need the money to fix a punctured tire on your crappy car with over 150,000 miles. One step forward, one step back. You need your car, so you pay for the tire repair. You want a house too, so figuring out how to save for a down payment must become a priority (fingers crossed that you don’t run over another nail anytime soon 🚗).

Debt

Like everyone else, you probably have debt. Debt shouldn’t hold you back from the American dream of owning a house. Paying off debt should be high on your list of priorities. Maybe the following are a few debt-related items you pay monthly:

- Student loan: $50/month

- Car loan: $200/month

- Credit card: $50/month

Open a spreadsheet, or grab a piece of paper, and write down what you pay towards debt each month. Paying down your debt will help you on your way to purchasing a home.

Groceries vs. Household Items

We have to eat, so make sure you add all your food expenses to your spreadsheet, and consider one more thing. When creating a budget, separate your grocery fund from your household items fund. Household items might include dishwashing soap, body wash, toilet paper, shampoo, etc.

It’s alarming when you go to the grocery store with a $100 budget, and after picking up groceries, deodorant, and facial moisturizer, your grocery budget has been seriously depleted because of the cost of household items.

Instead of buying household items at the grocery store, set aside a small, realistic budget for household items (ex. $25) and get them at a discount store. Please take my word for it, your grocery budget will thank you, and your household items budget will be stretched thanks to smart buying.

Assign Every Dollar

When creating your budget and preparing to save for a down payment on a house, assign every dollar to a section in your monthly budget. Are you eating out a lot? Add that to your budget. Buying lattes? Please put them in your budget. You want all of your spending to be accounted for so you can save money for what’s most important to you.

If you make $2000/month, $2000 should be broken down and assigned to your budget—every last penny.

- Rent: $800

- Electricity: $100

- Water: $60

- Internet: $50

- Phone: $35

- Car insurance: $40

Don’t forget to add recurring automatic purchases to your monthly budget. Those automatic payments could include Netflix, subscriptions, pet products, etc.

- Chewy subscription: $30

- Netflix subscription: $15

Variable Expenses

Even though we typically spend a certain amount each month on expenses, the total can vary due to inflation, surprise expenses for the kids (lost shoes need to be replaced), etc. Budgeting $100/week for groceries might not cut it with inflation. Some weeks you might spend $150 on groceries. This is where you’ll have to be honest with yourself about variable spending and adjust your budget accordingly.

- Groceries: $100-$150/week

- Gas: $100-$125/month

Savings

You’re making this budget to save for a down payment on a new home, but there may be other things you need to save for. Maybe you’ve been having problems with your refrigerator and know you’ll have to replace it soon, so you set aside $40 each month. You can successfully save for what’s most important to you if you purposefully add it to your budget.

- Down payment: $200

- Emergency savings: $50

- New refrigerator: $40

Money Left Over At the End of the Month

Let’s say your expenses leave you with $55 left over every month. Give the remaining $55 a job vs. spending it randomly. Putting the money towards your debt is always a good idea because you’re losing money on the interest accumulating on that debt.

Out-of-Balance Budget

What if you discover that instead of having a little bit of money left over at the end of the month, you’re spending more than you’re bringing in? This happens to many of us, but there are solutions to getting back on track with your budget. Consider the following suggestions to increase your budget and make it more manageable each month:

- Get rid of unnecessary recurring expenses, like subscriptions

- Instead of saving for a new refrigerator, buy a small used refrigerator when the current one breaks down

- Use public transportation instead of driving your car

- Ask for help from family and friends when it comes to covering school expenses, like when it’s your kid’s turn to bring cookies to school or when money is needed for travel to a tournament

- Avoid eating out, including fast food

- Buy less expensive food for your pet

- Add a second part-time job

Another option to help you earn more money to put towards debt and a down payment is to sell things you no longer need (children’s clothes they’ve outgrown, shoes you no longer wear, houseplants, etc.). An extra $50/month makes a big difference when trying to save for a down payment and pay off debt.

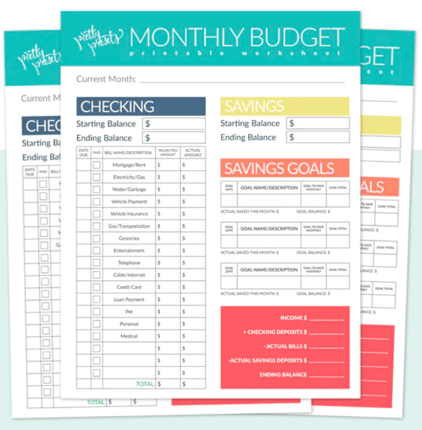

A monthly budget is easy to outline by hand, but you can also find downloadable options. Search “free printable budget forms” online, and you’ll be well on your way to creating and sticking to a budget that will help you save for a down payment on a new house.